How To Lower Debt To Credit Ratio . It's how much you spend with your credit card relative to. from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. To manually calculate dti, divide your total monthly debt payments by your monthly income. here are a few steps you can take to help lower your dti ratio: what is debt to credit ratio and how to calculate? Increase the amount you pay each month toward your existing.

from sbstandard.com

what is debt to credit ratio and how to calculate? from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. here are a few steps you can take to help lower your dti ratio: It's how much you spend with your credit card relative to. To manually calculate dti, divide your total monthly debt payments by your monthly income. Increase the amount you pay each month toward your existing.

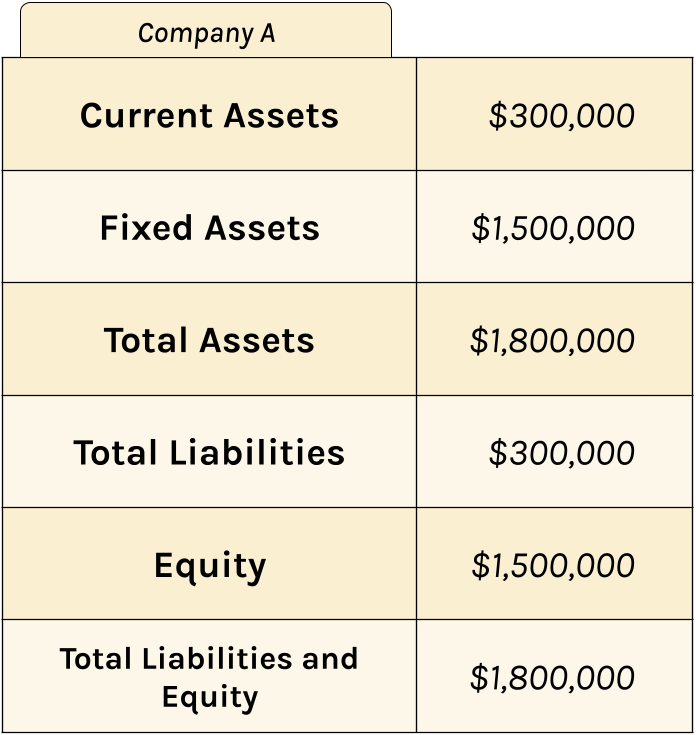

Debt to Assets Ratio Small Batch Standard

How To Lower Debt To Credit Ratio Increase the amount you pay each month toward your existing. To manually calculate dti, divide your total monthly debt payments by your monthly income. here are a few steps you can take to help lower your dti ratio: what is debt to credit ratio and how to calculate? from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. Increase the amount you pay each month toward your existing. It's how much you spend with your credit card relative to.

From www.youtube.com

Debt To Credit Ratio YouTube How To Lower Debt To Credit Ratio To manually calculate dti, divide your total monthly debt payments by your monthly income. what is debt to credit ratio and how to calculate? here are a few steps you can take to help lower your dti ratio: It's how much you spend with your credit card relative to. Increase the amount you pay each month toward your. How To Lower Debt To Credit Ratio.

From mortgagelab.co.nz

Debt to Ratios What Are They and How Are They Measured? How To Lower Debt To Credit Ratio from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. It's how much you spend with your credit card relative to. Increase the amount you pay each month toward your existing. To manually calculate dti, divide your total monthly debt payments by your monthly income. here are. How To Lower Debt To Credit Ratio.

From www.creditrepair.com

Figuring Out Your Ratio (DTI) How To Lower Debt To Credit Ratio what is debt to credit ratio and how to calculate? To manually calculate dti, divide your total monthly debt payments by your monthly income. from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. It's how much you spend with your credit card relative to. Increase the. How To Lower Debt To Credit Ratio.

From dxoaejcpd.blob.core.windows.net

How To Find Debt To Ratio at Rose Noble blog How To Lower Debt To Credit Ratio here are a few steps you can take to help lower your dti ratio: To manually calculate dti, divide your total monthly debt payments by your monthly income. Increase the amount you pay each month toward your existing. what is debt to credit ratio and how to calculate? It's how much you spend with your credit card relative. How To Lower Debt To Credit Ratio.

From www.youtube.com

Debt Service Coverage Ratio (Formula, Examples) DSCR Calculation How To Lower Debt To Credit Ratio It's how much you spend with your credit card relative to. To manually calculate dti, divide your total monthly debt payments by your monthly income. from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. Increase the amount you pay each month toward your existing. what is. How To Lower Debt To Credit Ratio.

From www.youtube.com

Ratio vs. DebttoCredit Ratio YouTube How To Lower Debt To Credit Ratio here are a few steps you can take to help lower your dti ratio: To manually calculate dti, divide your total monthly debt payments by your monthly income. from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. what is debt to credit ratio and how. How To Lower Debt To Credit Ratio.

From www.youtube.com

What is a Debt to Credit Ratio? Debt to Credit vs Debt to How To Lower Debt To Credit Ratio here are a few steps you can take to help lower your dti ratio: from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. Increase the amount you pay each month toward your existing. what is debt to credit ratio and how to calculate? It's how. How To Lower Debt To Credit Ratio.

From www.chase.com

What Is a DebtToCredit Ratio? Chase How To Lower Debt To Credit Ratio what is debt to credit ratio and how to calculate? from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. It's how much you spend with your credit card relative to. To manually calculate dti, divide your total monthly debt payments by your monthly income. here. How To Lower Debt To Credit Ratio.

From einvestingforbeginners.com

What a Good Debt to Asset Ratio Is and How to Calculate It How To Lower Debt To Credit Ratio what is debt to credit ratio and how to calculate? here are a few steps you can take to help lower your dti ratio: It's how much you spend with your credit card relative to. from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. Increase. How To Lower Debt To Credit Ratio.

From www.youtube.com

How To Calculate To Debt To Credit Ratio? YouTube How To Lower Debt To Credit Ratio Increase the amount you pay each month toward your existing. To manually calculate dti, divide your total monthly debt payments by your monthly income. here are a few steps you can take to help lower your dti ratio: It's how much you spend with your credit card relative to. what is debt to credit ratio and how to. How To Lower Debt To Credit Ratio.

From www.bestegg.com

Ways to Manage Your Debt Best Egg® Financial Tips How To Lower Debt To Credit Ratio To manually calculate dti, divide your total monthly debt payments by your monthly income. what is debt to credit ratio and how to calculate? here are a few steps you can take to help lower your dti ratio: It's how much you spend with your credit card relative to. Increase the amount you pay each month toward your. How To Lower Debt To Credit Ratio.

From accountingcorner.org

Debt to Asset Ratio Accounting Corner How To Lower Debt To Credit Ratio Increase the amount you pay each month toward your existing. what is debt to credit ratio and how to calculate? here are a few steps you can take to help lower your dti ratio: It's how much you spend with your credit card relative to. from a pure risk perspective, debt ratios of 0.4 (40%) or lower. How To Lower Debt To Credit Ratio.

From www.caminofinancial.com

How To Calculate Debt To Credit Ratio Debt To Credit Ratio Calculator How To Lower Debt To Credit Ratio from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. Increase the amount you pay each month toward your existing. here are a few steps you can take to help lower your dti ratio: To manually calculate dti, divide your total monthly debt payments by your monthly. How To Lower Debt To Credit Ratio.

From sbstandard.com

Debt to Assets Ratio Small Batch Standard How To Lower Debt To Credit Ratio To manually calculate dti, divide your total monthly debt payments by your monthly income. Increase the amount you pay each month toward your existing. what is debt to credit ratio and how to calculate? here are a few steps you can take to help lower your dti ratio: from a pure risk perspective, debt ratios of 0.4. How To Lower Debt To Credit Ratio.

From www.gnty.com

How Ratio Affects Your Credit Guaranty Bank & Trust How To Lower Debt To Credit Ratio here are a few steps you can take to help lower your dti ratio: To manually calculate dti, divide your total monthly debt payments by your monthly income. what is debt to credit ratio and how to calculate? from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio. How To Lower Debt To Credit Ratio.

From fabalabse.com

How do you calculate credit to debt ratio? Leia aqui What is an How To Lower Debt To Credit Ratio here are a few steps you can take to help lower your dti ratio: It's how much you spend with your credit card relative to. Increase the amount you pay each month toward your existing. what is debt to credit ratio and how to calculate? from a pure risk perspective, debt ratios of 0.4 (40%) or lower. How To Lower Debt To Credit Ratio.

From www.youtube.com

Maintain an ideal debttocredit ratio YouTube How To Lower Debt To Credit Ratio Increase the amount you pay each month toward your existing. what is debt to credit ratio and how to calculate? To manually calculate dti, divide your total monthly debt payments by your monthly income. here are a few steps you can take to help lower your dti ratio: from a pure risk perspective, debt ratios of 0.4. How To Lower Debt To Credit Ratio.

From efinancemanagement.com

Debt Ratio Definition, Formula, Use, Ideal, Example eFM How To Lower Debt To Credit Ratio here are a few steps you can take to help lower your dti ratio: what is debt to credit ratio and how to calculate? It's how much you spend with your credit card relative to. from a pure risk perspective, debt ratios of 0.4 (40%) or lower are considered better, while a debt ratio of 0.6. Increase. How To Lower Debt To Credit Ratio.